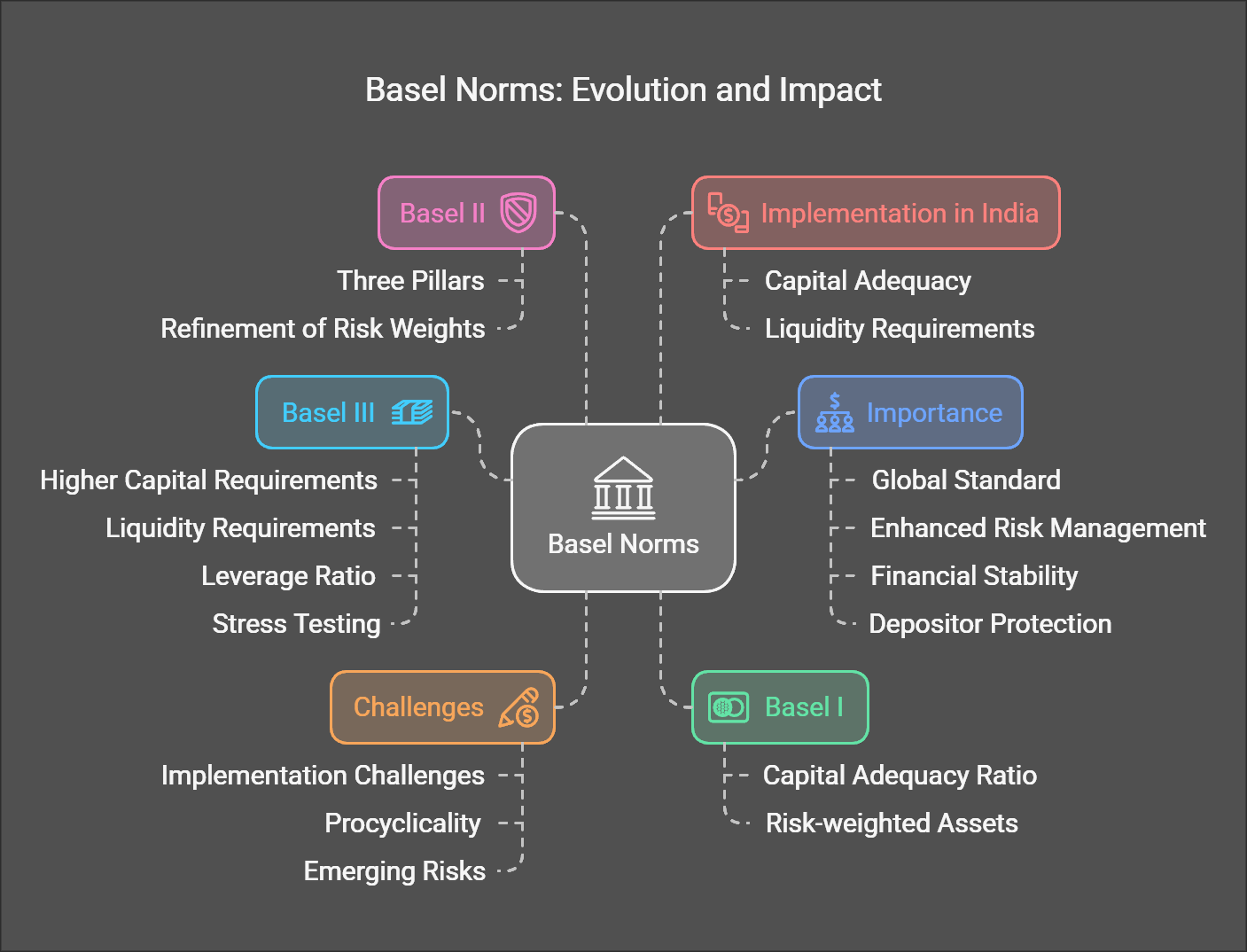

Basel Norms

Basel norms are a set of international banking regulations developed by the Basel Committee on Banking Supervision (BCBS). These norms aim to strengthen the regulation, supervision, and risk management of banks worldwide. The goal is to ensure the stability and soundness of the global banking system.

Basel I

- Introduced in 1988.

- Focus: Primarily focused on credit risk.

-

Key elements:

- Capital Adequacy Ratio (CAR): Introduced the concept of CAR, requiring banks to maintain a minimum CAR of 8% of risk-weighted assets.

- Risk-weighted assets: Assets were categorized into different risk categories, with higher risk assets requiring more capital.

Basel II

- Introduced in 2004.

- Focus: Expanded to cover market risk and operational risk, in addition to credit risk.

-

Key elements:

-

Three Pillars:

- Pillar 1: Minimum capital requirements for credit, market, and operational risks.

- Pillar 2: Supervisory review process to ensure banks have adequate capital and risk management systems.

- Pillar 3: Market discipline through enhanced disclosures of risk information.

- Refinement of risk weights: More sophisticated risk assessment methods were introduced.

-

Three Pillars:

Basel III

- Introduced in 2010 (in response to the 2008 financial crisis).

- Focus: Strengthening capital requirements, improving risk management, and promoting financial stability.

-

Key elements:

- Higher capital requirements: Increased minimum CAR and introduced capital buffers (Capital Conservation Buffer, Countercyclical Buffer).

- Liquidity requirements: Introduced Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) to ensure banks have sufficient liquidity.

- Leverage ratio: Introduced a leverage ratio to limit excessive leverage.

- Stress testing: Enhanced stress testing requirements to assess banks' resilience to adverse economic conditions.

Importance of Basel Norms

- Global Standard: Provides a common framework for banking regulation, promoting consistency and stability across countries.

- Enhanced Risk Management: Encourages banks to adopt more sophisticated risk management practices.

- Financial Stability: Strengthens the resilience of the banking system to financial shocks.

- Depositor Protection: Helps protect depositors' money by ensuring banks have adequate capital and liquidity.

Basel Norms in India

The Reserve Bank of India (RBI) has adopted the Basel norms for banks operating in India. Indian banks are required to comply with the capital adequacy, liquidity, and other requirements as per the Basel framework.

Challenges and Future Outlook

- Implementation Challenges: Implementing Basel III norms can be complex and costly, particularly for smaller banks.

- Procyclicality: Concerns that Basel norms can exacerbate economic cycles by restricting lending during downturns.

- Emerging Risks: The regulatory framework needs to keep pace with emerging risks, such as climate change and cybersecurity.

The Basel Committee continues to review and refine the Basel framework to address these challenges and ensure its effectiveness in promoting global financial stability.

No Comments