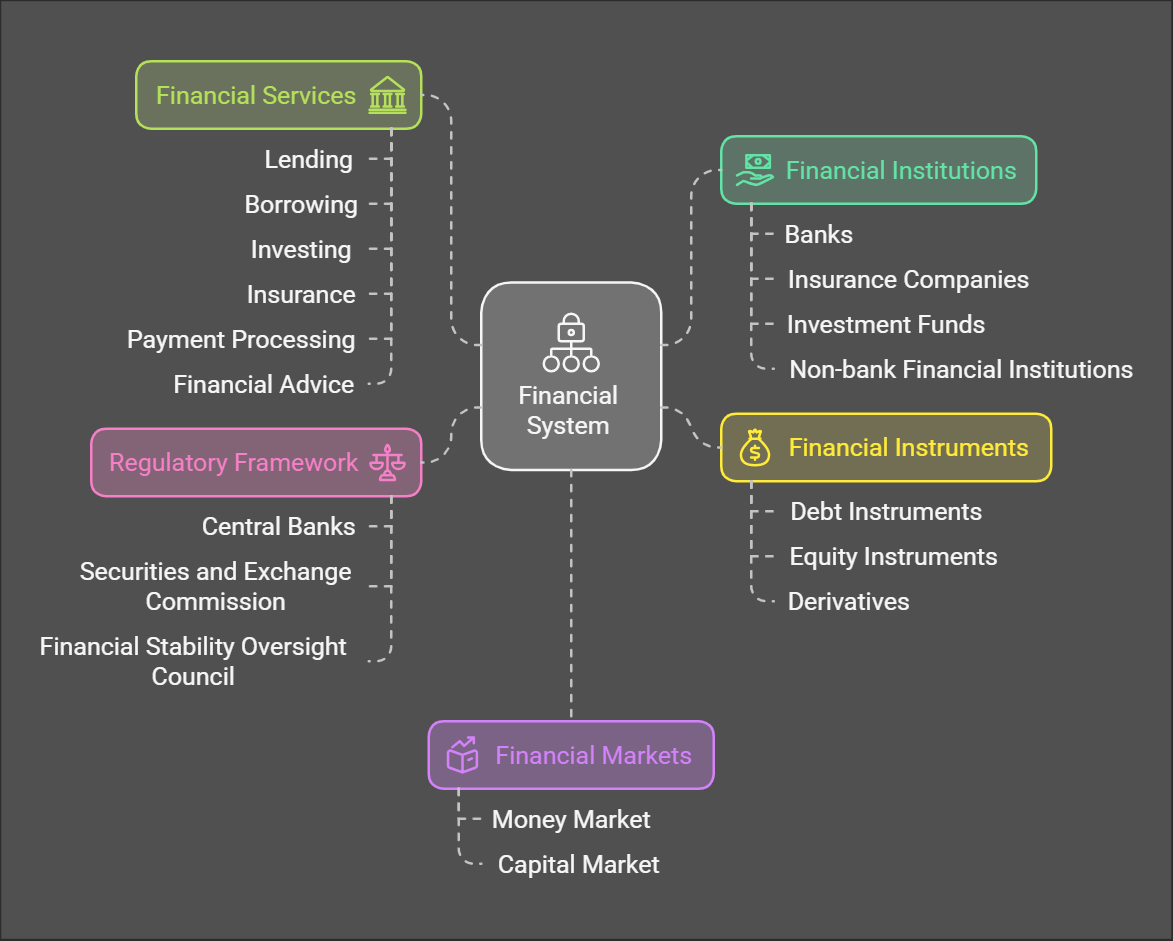

Structure of Financial System

The financial system is a complex network of institutions, markets, and instruments that facilitate the flow of funds between savers and borrowers. Here's a breakdown of its key components:

1. Financial Institutions:

-

Banks:

- Commercial banks (e.g., Chase, Bank of America)

- Investment banks (e.g., Goldman Sachs, Morgan Stanley)

- Savings and loan associations

- Credit unions

-

Insurance Companies:

- Life insurance companies

- Property and casualty insurance companies

-

Investment Funds:

- Mutual funds

- Hedge funds

- Pension funds

-

Non-bank Financial Institutions:

- Finance companies

- Leasing companies

- Mortgage companies

2. Financial Markets:

-

Money Market: Deals with short-term debt instruments (less than one year).

- Examples: Treasury bills, commercial paper

-

Capital Market: Deals with long-term debt and equity instruments.

- Examples: Stocks, bonds, mortgages

3. Financial Instruments:

-

Debt Instruments:

- Bonds (issued by governments and corporations)

- Loans (mortgages, car loans)

- Bills (short-term debt instruments)

-

Equity Instruments:

- Stocks (represent ownership in a company)

-

Derivatives:

- Options, futures, swaps (contracts based on underlying assets)

4. Financial Services:

- Lending

- Borrowing

- Investing

- Insurance

- Payment processing

- Financial advice

5. Regulatory Framework:

- Central banks (e.g., Federal Reserve in the US)

- Securities and Exchange Commission (SEC)

- Financial Stability Oversight Council (FSOC)

How it Works:

- Savers deposit their money in banks, purchase bonds, or invest in stocks.

- Borrowers obtain funds from banks, issue bonds, or sell stock.

- Financial institutions act as intermediaries, connecting savers and borrowers.

- Financial markets provide a platform for the buying and selling of financial instruments.

- Regulatory bodies ensure the stability and integrity of the financial system.

Key Functions of the Financial System:

- Efficient allocation of capital: Directing funds to the most productive investments.

- Price discovery: Determining the fair value of financial assets.

- Risk management: Helping individuals and businesses manage financial risks.

-

Economic growth: Supporting economic activity by facilitating investment and innovation.

Financial Services

Lending

Financial Institutions

Borrowing

Investing

Banks

Insurance

Insurance Companies

Payment Processing

Investment Funds

Financial Advice

Non-bank Financial Institutions

Financial System

Regulatory Framework

Financial Instruments

Central Banks

Debt Instruments

Securities and Exchange Commission

Equity Instruments

Derivatives

Financial Stability Oversight Council

Financial Markets

Money Market

Capital Market

This structure illustrates how the various components of the financial system interact to facilitate the flow of funds and support economic growth.

This structure illustrates how the various components of the financial system interact to facilitate the flow of funds and support economic growth.

No Comments