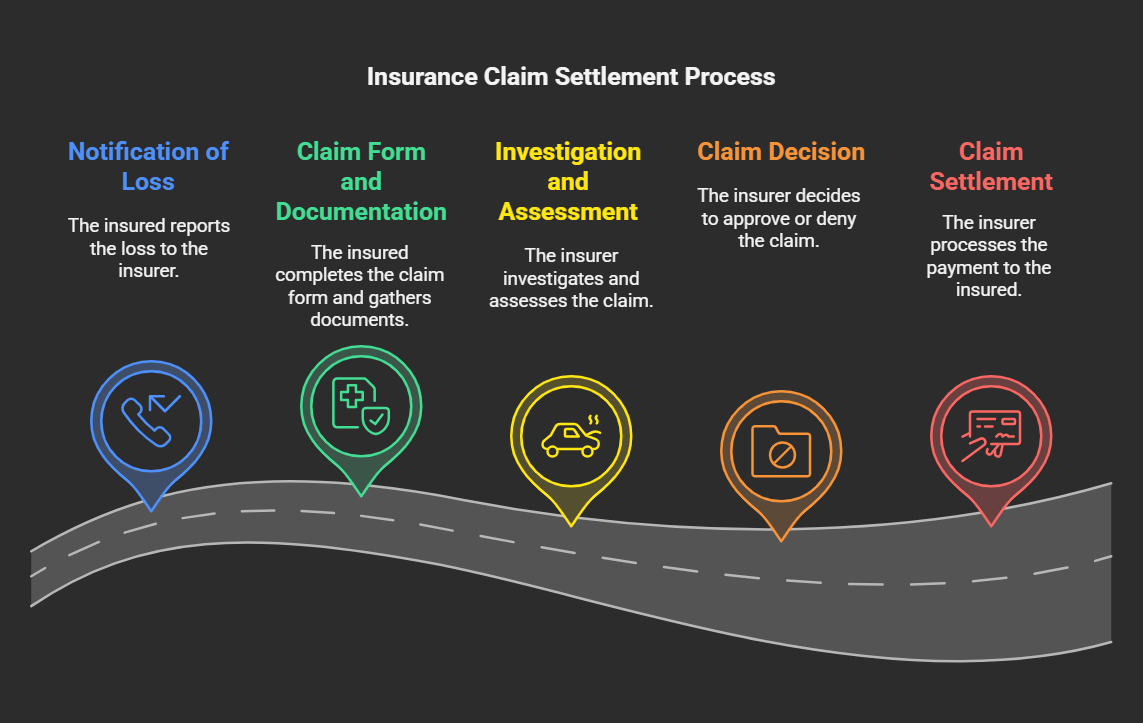

Claim Settle Process

The claim settlement process is a critical part of the insurance experience. It's the point where the insurer fulfills its promise to provide financial protection. While the specifics can vary depending on the type of insurance and the insurer, here's a general overview:

.

- Notification of Loss:

Prompt Reporting: The insured must notify the insurance company as soon as possible after a loss occurs. This can typically be done via phone, online, or through an agent. Information Provided: The insured will need to provide details about the incident, including the date, time, location, and nature of the loss. Providing accurate and complete information is crucial.

- Claim Form and Documentation:

Claim Form: The insurer will provide a claim form that needs to be completed and submitted. Supporting Documentation: The insured will need to gather and provide supporting documentation, such as: Police reports (for theft or accidents) Medical records (for health claims) Repair estimates (for property damage) Photos or videos of the damage Invoices or receipts Importance of Records: Maintaining thorough records is essential for a smooth claim process.

- Investigation and Assessment:

Insurer's Investigation: The insurer will investigate the claim to verify the loss and determine its cause. This may involve: Reviewing documentation Interviewing witnesses Inspecting the damage Engaging a surveyor or loss assessor Loss Assessment: The insurer will assess the extent of the loss and determine the amount of compensation payable.

- Claim Decision:

Claim Approval: If the claim is approved, the insurer will proceed with payment. The payment amount will be based on the policy terms and the assessed loss. Claim Denial: If the claim is denied, the insurer will provide a written explanation of the reasons for the denial. The insured may have the right to appeal the decision.

- Claim Settlement:

Payment Methods: Payment may be made by check, electronic transfer, or direct payment to a service provider (e.g., a repair shop). Deductibles and Co-payments: The insured will be responsible for paying any applicable deductibles or co-payments. Release Form: The insured may be required to sign a release form, acknowledging receipt of payment and waiving any further claims.

Key Factors for a Smooth Claim Process:

Timely Notification: Report the loss promptly. Accurate Information: Provide accurate and complete information. Documentation: Gather and maintain thorough documentation. Communication: Maintain open communication with the insurer. Policy Understanding: Understand the terms and conditions of your insurance policy. By following these steps and providing the necessary information, insured individuals can help ensure a smooth and efficient claim settlement process.

No Comments